Once you exceed a base level income and asset, things can confusing. Noel Whittaker helps you with planning your retirement.

The latest six-monthly age pension adjustments have taken place and are effective from 20 March 2021. The main changes are a slight increase in the amount of the age pension, which also leads to an increase in the cut off points for both the assets test and the income test. The maximum pension for a single person is now $952.70 a fortnight, and for a couple $718.10 a fortnight each.

Everybody is allowed a certain base level of income and assets, but once you exceed the base level the pension reduces. For income test purposes the pension reduces by $0.50 for every additional dollar earned over the threshold, and by three dollars a fortnight for every $1000 of assets over the bottom limit.

The lower asset limits are $268,000 for a single pensioner and for a couple $401,500. Once these levels are exceeded the pension tapers until it reaches the upper cut off point where no pension is payable. The base income threshold is $316 a fortnight for a couple and $178 fortnight for a single.

The cut-off point for a homeowner couple has gone up to $880,500 and for a single pensioner $585,750. For non-homeowners the numbers are $1,095,000 and $800,250 respectively. The income test cut-off points are now $82,898.40 per annum for a couple and $54,168.40 for a single.

How do you qualify? First, you have to be of pensionable age which depends on the date you were born. For people born between 1 January 1954 and 30 June 1955 pensionable age is 66, for people born between 1 July 1955 and 31 December 1956 it’s 66.5 years and for those born on or after 1 January 1957 it is 67.

If one partner is eligible, and the other is under pensionable age, the eligible partner receives half the couple’s pension. For example, a 67 year old with a 59 year old partner could qualify for 50% of the couple’s pension.

You are tested under both an assets and an income test, and Centrelink applies the test that gives you the least pension. Consider a homeowner couple with assessable income of $700 a fortnight and assessable assets of $740,000. Their pension under the income test would be $622.10 a fortnight each – under the assets test $210.35. Therefore, they would qualify for an age pension of $210.35 a fortnight all each

The value of your assets does not include your family home, while your chattels such as furniture, car and boat are valued at second hand value, not replacement value. This puts a figure of $5,000 on most people’s furniture.

If the value of your investments has fallen, there may be an increase in your payment – if the value of your investments has increased, then your payment may go down.“

The income test includes items such as employment income, overseas pensions and rents received- financial assets are given a deemed income. They are deemed to be earning .25% for the first $88,000 ($53,000 for singles), and 2.25% on the balance. For example, if a couple had $488,000 of financial assets their deemed income would be $9,220 a year being .25% for the first $88,000 ($220) and 2.25% on $400,000 ($9,000).

The term “financial assets” includes interest bearing deposits, shares, managed funds, and money in superannuation if the fund member has reached pensionable age, However, it does not include property. The property value less any mortgage on that property are used for the assets test, and the net rental income after expenses is used for the income test.

The income test is not relevant if you are asset tested. For example, a single person with assets of $540,000 and receiving a pension of $136.70 fortnight could earn have assessable income of 45,000 a year including their deemed income, and employment income, without affecting their pension because they would still be asset tested.

The deeming rates are a gift for people with money in high performing superannuation funds which have been averaging 8% per annum. There is no penalty if your assets can achieve a better return than the deeming rates return.

Each year on 20 March and 20 September Centrelink values your market linked investments, such as shares and managed investments, based on the latest unit prices held by them. These investments are also revalued when you advise of a change to your investment portfolio or when you request a revaluation of your shares and managed investments. If the value of your investments has fallen, there may be an increase in your payment – if the value of your investments has increased, then your payment may go down.

The rules are in favour of pensioners. If the value of your portfolio arises because of market movements you are not required to advise Centrelink of the change – it will happen automatically at the next six monthly revaluation. However, if your portfolio falls you have the ability to notify Centrelink immediately.

You can reduce your assets by giving part of your money away but seek advice before you do it. The Centrelink rules only allow gifts of $10,000 in a financial year with a maximum of $30,000 over five years. Using these rules a would-be pensioner could gift away $10,000 before June 30th and $10,000 just after it, and so reduce their assessable assets by $20,000.

The rules are prima facie simple, but there is devil in the detail. If a member of a couple has not reached pensionable age it’s prudent, if appropriate, to keep as much of the superannuation in the younger person’s name because then it is except from assessment by Centrelink. However, the moment that fund is moved to pension mode, it’s assessable irrespective of the age of the member.

Furthermore, a debt against an investment asset is not deducted from the asset value, unless the mortgage is held against the investment asset. It is not uncommon for people to have a large mortgage secured by their house, for an investment property – in that case Centrelink assess the gross value of the property and do not deduct the loan.

PROFILE

Noel Whittaker

Noel Whittaker is the author of Retirement Made Simple and numerous other books on personal finance. His advice is general in nature and readers should seek their own professional advice before making any financial decisions.

Email / noel@noelwhittaker.com.au

Website / www.noelwhittaker.com.au

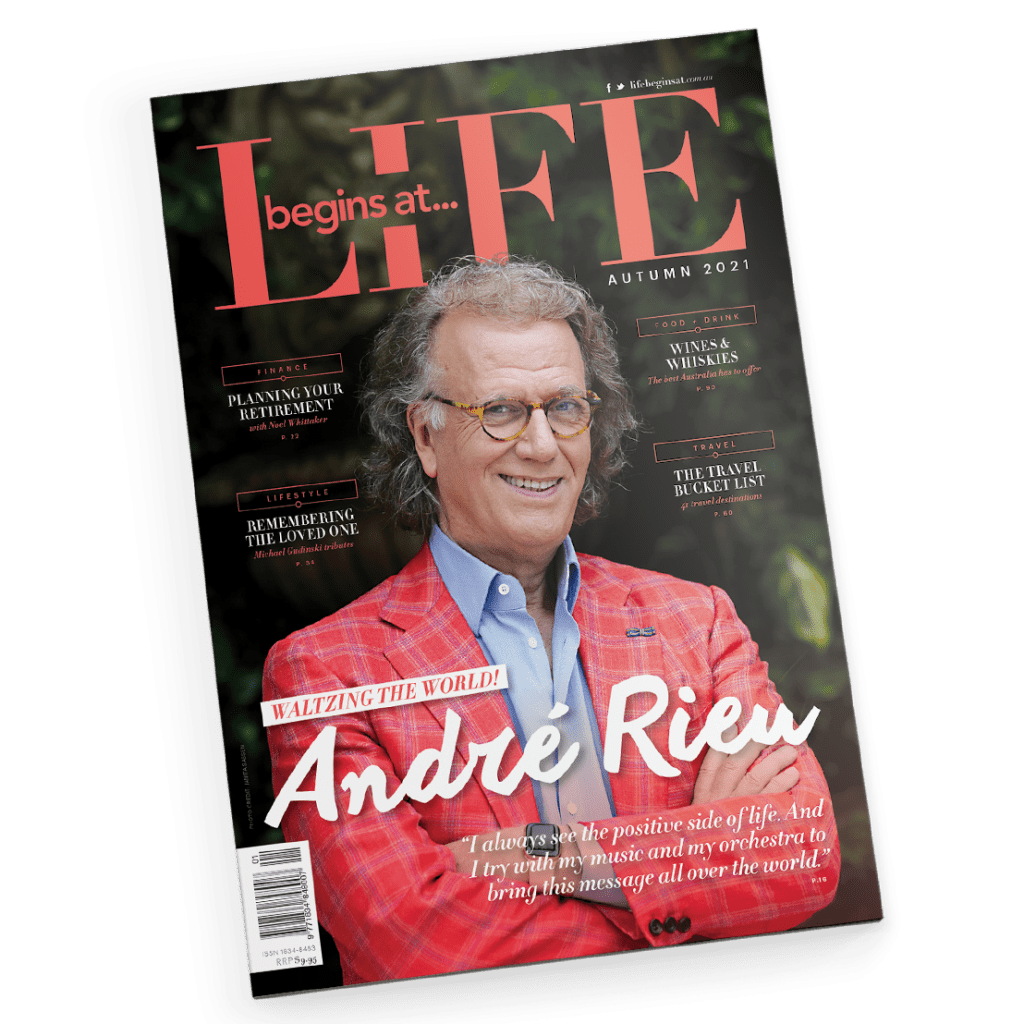

This article appeared in the Autumn 2021 edition of Life Begins At… Click here to read or here to subscribe and never miss an issue!

Add Comment