The investing landscape is full of rules of thumb and little mottos like ‘it’s not timing the market, it’s time in the market’. But it’s important to distinguish what’s useful and what is just a plain myth.

Ask any stockbroker when is the right time to invest in shares and the answer will likely be ‘now’ – regardless of whether it is 2009 when share prices had tanked post global financial crisis, or 1999 at the peak of the tech bubble.

Is it possible that ‘right now’ is always the best time to buy?

‘Time in the market’ is a convenient slogan, which is rooted in sensible investing principles but has been compromised by self-interested spruikers.

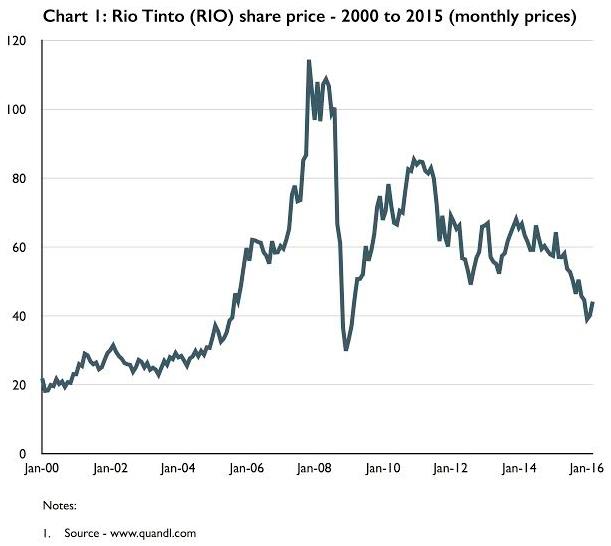

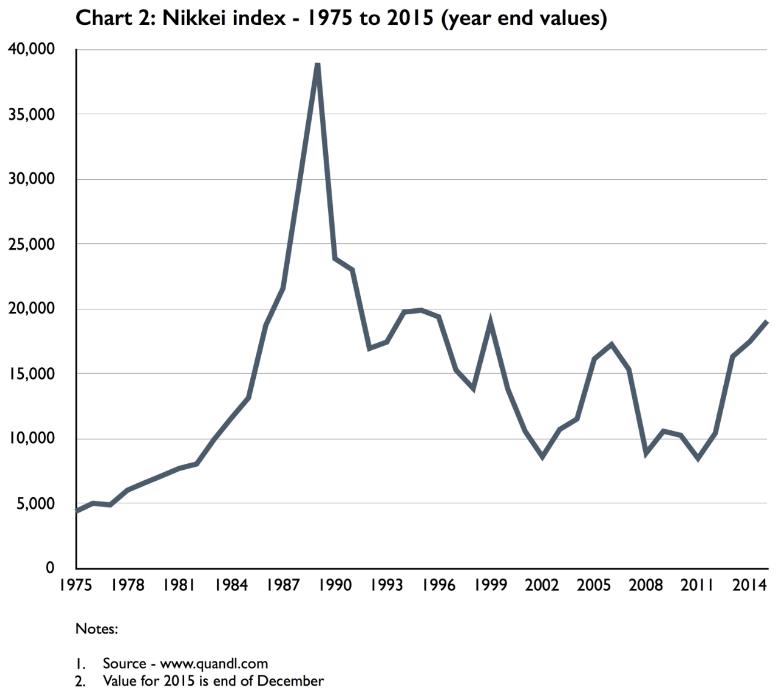

While it is important to take a long-term view and refrain from trying to ‘time the market’, when investing in shares and other growth assets, the price you pay matters. In other words, you can’t just buy at any price and leave it to time to produce a return. Anyone who invested in Rio Tinto at its peak in 2008, or the Japanese share market (represented by the Nikkei index) in late 1989, is unlikely to ever recover the lost spending power, regardless of how many years or decades they’ve got up their sleeve (see Charts 1 and 2).

Markets do not generate predictable, steady returns over time. History shows that markets can hit long-term highs that are not repeated any time soon. The Nikkei reached a record high of 38,916 in 1989 and now, almost three decades later, sits just under 17,000 (although investors would have received dividends in the interim). Rio’s price today is a little over a third of its 2008 high.

The lesson is simple: if you happen to invest at a long-term peak, time won’t be enough to bail you out. The price you pay for an investment is the key to making money.

Property investors should also heed this lesson. Spruikers might tell you that all you need is time and you’ll make money from property, but that’s not always the case. Ask property owners in regional Australia or from overseas; many people have spent a decade or more with negative equity on their property investment.

Fortunately, falls earlier in the year in the Australian share market mean that ‘long-term highs’ are less of a concern for investors in many sectors or the market broadly. That is not to say that ‘now’ is the perfect time to buy – but being brave enough to buy in after the market has fallen in price, will more likely produce better long-term results than buying in when everyone has been admiring a period of strong performance.

If an investment you are considering has had a strong run and sits at never before seen prices, beware the ‘long-term high’. In the long-term, you won’t be rewarded for paying way too much for an asset no matter how much time you have in the market.

Written by Richard Livingston, is a founder of Eviser. Eviser is an online financial advice service helping you take control of your super through investment advice, model portfolios and expert Q&A. This article contains general investment advice only (under AFSL 469838). This information has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs.

Add Comment