‘Cash is king’ the saying goes, but not always for the conservative investor.

Investing in shares can be daunting for many people. Some think it’s gambling, others simply can’t stomach the unpredictable price movements.

But even if you’re a conservative investor, allocating a meaningful portion of your super or investment portfolio to shares – both Australian and international – can make sense.

The time frame over which you’re investing is a very important consideration. If you’re investing money you need to spend within the next few years, cash (in the form of a bank account or term deposit) is king. The beauty of cash is that – barring financial disaster – you know you’ll receive back your initial investment plus a little bit of interest.

In the short-term, the price of other investments like shares tends to bounce around from one day to the next. If you need to spend the funds a year from now, investing in shares presents the risk that they are suffering a temporary downturn in price when you need to sell them.

Price volatility is not limited to shares – property can also be a tough short-term proposition. Not only is there the price to worry about, but you also need to cover the large upfront transaction costs you incur (for example, stamp duty) and back-end commissions to your agent.

Over the long-term – especially decades or more – things become very different. Cash struggles to hold its purchasing power due to inflation – the tendency of prices to increase over time. This means that $1 buys you less in the future than it does today.

The only certainty you’ll get from holding all your savings in cash for a decade is that your savings will buy you roughly what they could have bought today, or probably less.

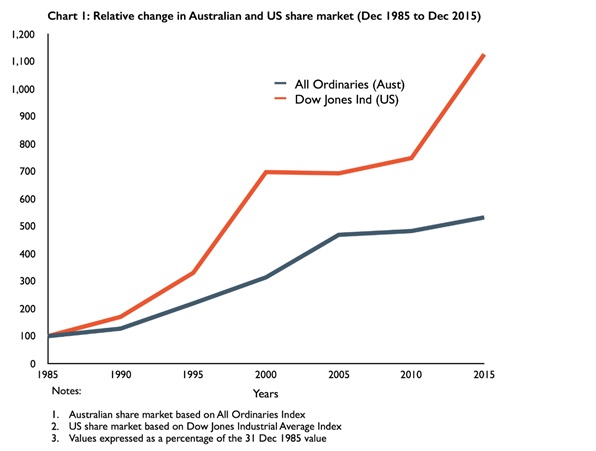

While volatile in the short-term, shares aren’t as volatile when viewed over much longer time frames. Chart 1 shows the price movements in value of the overall Australian and US share markets over the last 30 years.

There are two key points to note. Firstly, the chart ignores dividends; overall returns to share investors would have been far greater than the 8.4 per cent and 5.7 per cent compound annual growth shown here. Secondly, I’ve used quinquennial (five year) prices, rather than the daily or monthly pricing normally displayed in share market charts.

The chart clearly shows that despite several financial crises, starting with the 1987 share market crash, share markets have tended to rise over longer periods of time. Those invested in cash over this period would have fared much worse.

That’s not to say there won’t be ups and downs or that you can’t lose money investing in shares. For instance, buying hot stocks in a booming market – like the now defunct ABC Learning which grew earnings rapidly by taking on lots of debt – can quickly lose you a lot of money.

We’re also not suggesting conservative investors allocate all their money to the share market. There are good reasons for investors, especially retirees who need certainty of income, to hold some of their portfolios in bonds, term deposits and bank accounts.

But if you’re investing all your money into cash because investing in shares seems too much of a gamble, history shows that you’re probably going to lose out. When done sensibly and viewed through a long-term lens, investing in shares hasn’t been a gamble, but a proven strategy for wealth creation.

Annika Bradley is the Head of SMSF Investment Solutions at online financial advice service Eviser. Annika was previously a Portfolio Manager at QSuper and Mosaic Portfolio Advisers. Annika has extensive investment experience and is passionate about providing as many Australians as possible access to an adequate retirement income stream by empowering them through education.

This article contains general investment advice only (under AFSL 469838). This information has been prepared without taking account of your objectives, financial situation or needs. Because of this you should, before acting on this information, consider its appropriateness, having regard to your objectives, financial situation and needs.

These last few years have developed(developing?) into a perfect financial storm, from a self funded retiree point of view.

The Gov’t, in their wisdom have reduced the threshold for access to part pensions, which in turn means we will lose access to council rates, water, electricity, and car rego reductions. Oh and also my little dogs rego reductions. The pollies have a great pension system, so I guess, do no really care.

Bank int rates for in bank and Term Deposits pay 0.5 – 2.65%, hardly a good number to live off from your savings. Money is very safe, but you can’t live off the interest.

Managed funds still good returns, though, your principal is being constantly eroded, so need to keep your eye on this as well. You might earn $5,000 in dividends, but lose $8,000 in principal

Never understood or comfortable with Bonds, but from what I see, also low int with pretty high risk of default.

The share market is very unsettled these days and cycles up a little, down a lot. Most of the companies I have in my portfolio are fundamentally sound, but investors, being spooked, are leaving, causing the share prices to reduce. Company dividends and imputated credits are still good and the only thing keeping us afloat. As I said earlier, with share prices tumbling, you have to hold the faith as the price will return, assuming, the company remains sound.

Unfortunately, due to the above, many retirees are forced into the investment world with their monies. I guess if they get it wrong and / or it all goes pear shaped for them, then the Government will have many more people on the part/full pension. Maybe the Government could set up a Pension Bond, only for retirees, pays 10%….Now that would get some monies from under the mattress.